Who are Dividend Aristocrats?

Dividend Aristocrats are companies which are increasing dividends for at least 25 years, this demonstrates their financial stability and strong business models. However, be careful and conduct your own research to check the company's financial health. If a company is marked as a Dividend Aristocrat, it doesn't always mean it's 100% a good investment.

Basic Characteristics but not a condition

- - Consistent dividend growth for 25+ years

- - Member of the S&P 500 index

- - Typically large-cap, well-established companies

- - Often have strong brand recognition and market presence

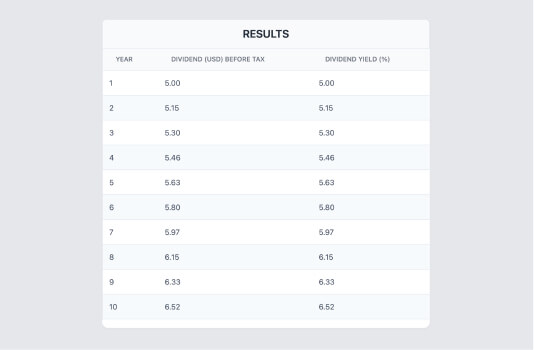

Expected Dividend Yield Calculator

Calculate expected dividend yields and analyze dividend growth patterns.

Try tool for free

Examples of Dividend Aristocrats

While the Dividend Aristocrats list can change from year to year, some well-known examples include:

- - Procter & Gamble (PG) - Consumer goods giant with over 60 years of consecutive dividend increases

- - Johnson & Johnson (JNJ) - Diversified healthcare company boasting nearly 60 years of dividend growth

- - Coca-Cola (KO) - Beverage behemoth with over 60 years of consistent dividend increases

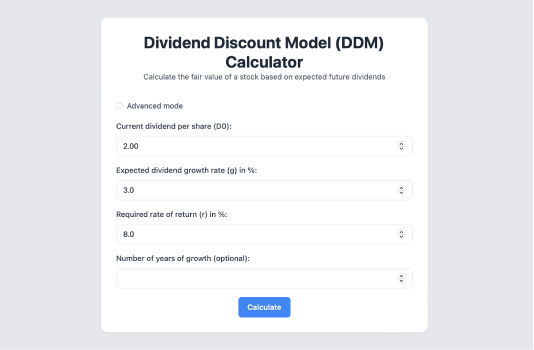

Dividend Discount Model Calculator

Value dividend-paying stocks using the Dividend Discount Model.

Try tool for free

Considerations for Investors

Dividend Aristocrats seem like very nice investments, and therefore it is very important to know that past performances are not a guarantee of the future. Keep in mind the importance of diversification in a portfolio. And last but not least: double check and do your own research.