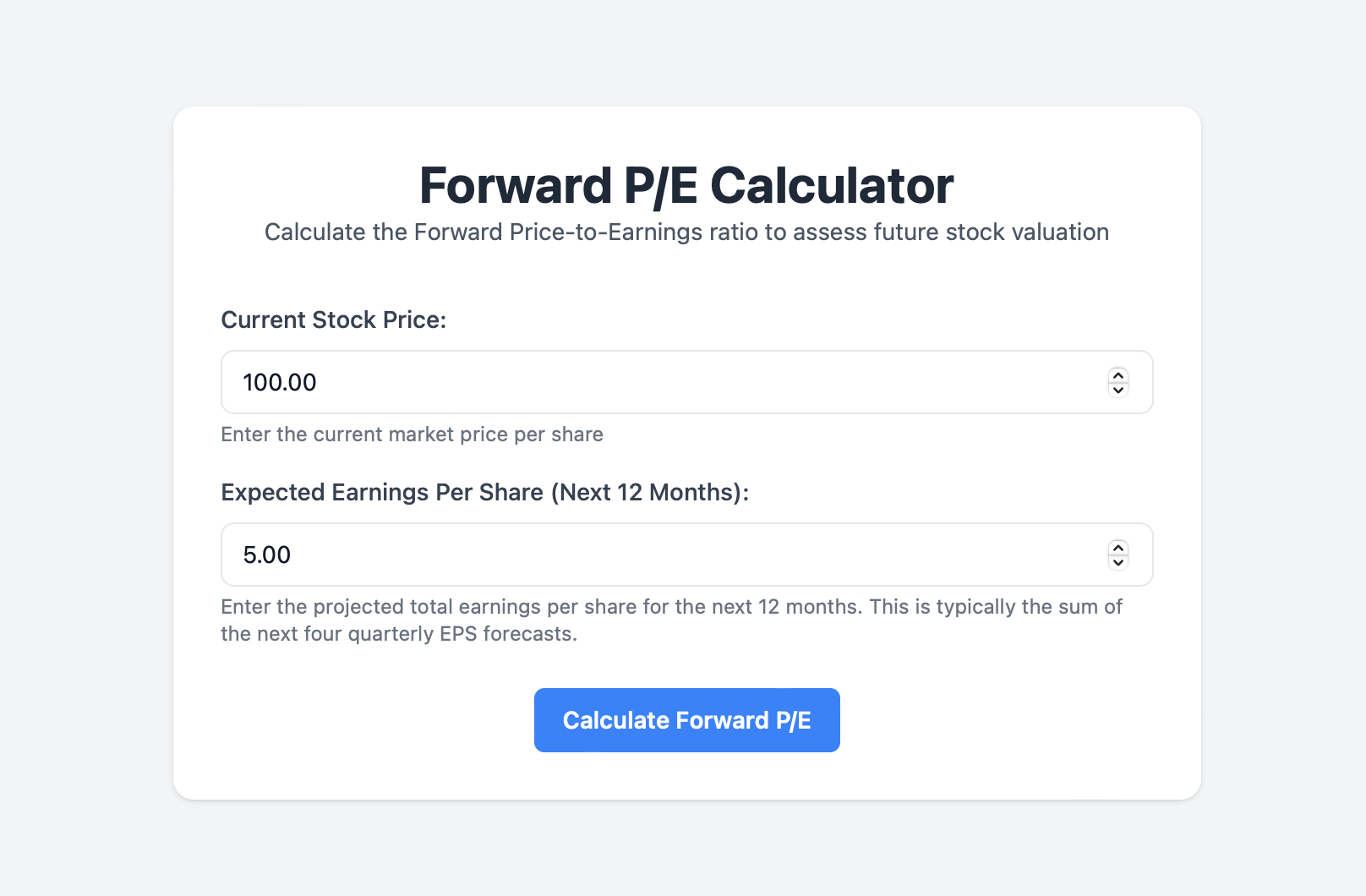

Forward P/E Calculator

Purpose

The Forward P/E Calculator helps investors assess a stock's valuation based on future earnings expectations. It's a key tool for comparing current stock prices with projected earnings.

Usage

Enter the current stock price and the expected earnings per share (EPS) for the next 12 months. The calculator will compute the Forward P/E ratio and provide an interpretation of the result.

Interpretation

A lower Forward P/E may indicate an undervalued stock or expected earnings decline. A higher ratio might suggest overvaluation or high growth expectations. The tool provides context-specific interpretations based on the calculated ratio.

Formula

The Forward P/E ratio is calculated using the following formula:

Forward P/E = Current Stock Price / Expected Earnings Per Share (Next 12 Months)

Where:

- Current Stock Price is the present market value of one share

- Expected Earnings Per Share is the projected total EPS for the next 12 months

Forward P/E Calculator

Calculate the Forward Price-to-Earnings ratio to assess future stock valuation